Quarterly Report

Gutmann Portfolio Management Report

Q1 2023

With a steady hand.

You find a short version of the decisions we have made in Gutmann Portfolio Management and our market assessments below, or click on the download link to read the quarterly report in full in PDF format.

- Entering 2023 with optimism.Investments in equities.In mid-September of 2022, we invested more in equities and, in return, reduced the proportion of bonds in the asset management portfolios.

- Convictions were tested.Bank failure in March.On March 10, U.S. authorities declared Silicon Valley bank SVB insolvent. the institution was number 16 in the U.S. in terms of size. On Sunday, March 19, Credit Suisse, the major Swiss bank in distress, was taken over by its competitor UBS.

- Act with calm.Gains in equities and bonds.Both equity and bond strategies of the Gutmann portfolio management closed the quarter on a positive note. Once again, navigating through the storm with a steady hand at the helm paid off.

Gains in equities and bonds.

No one can seriously predict how the prices of stocks and bonds will develop over the next few months. However, we know the earnings of companies, which are published on a quarterly basis, and we know the interest rate landscape. The fourth-quarter 2022 corporate earnings released earlier this year were down. But that did not come as a surprise.

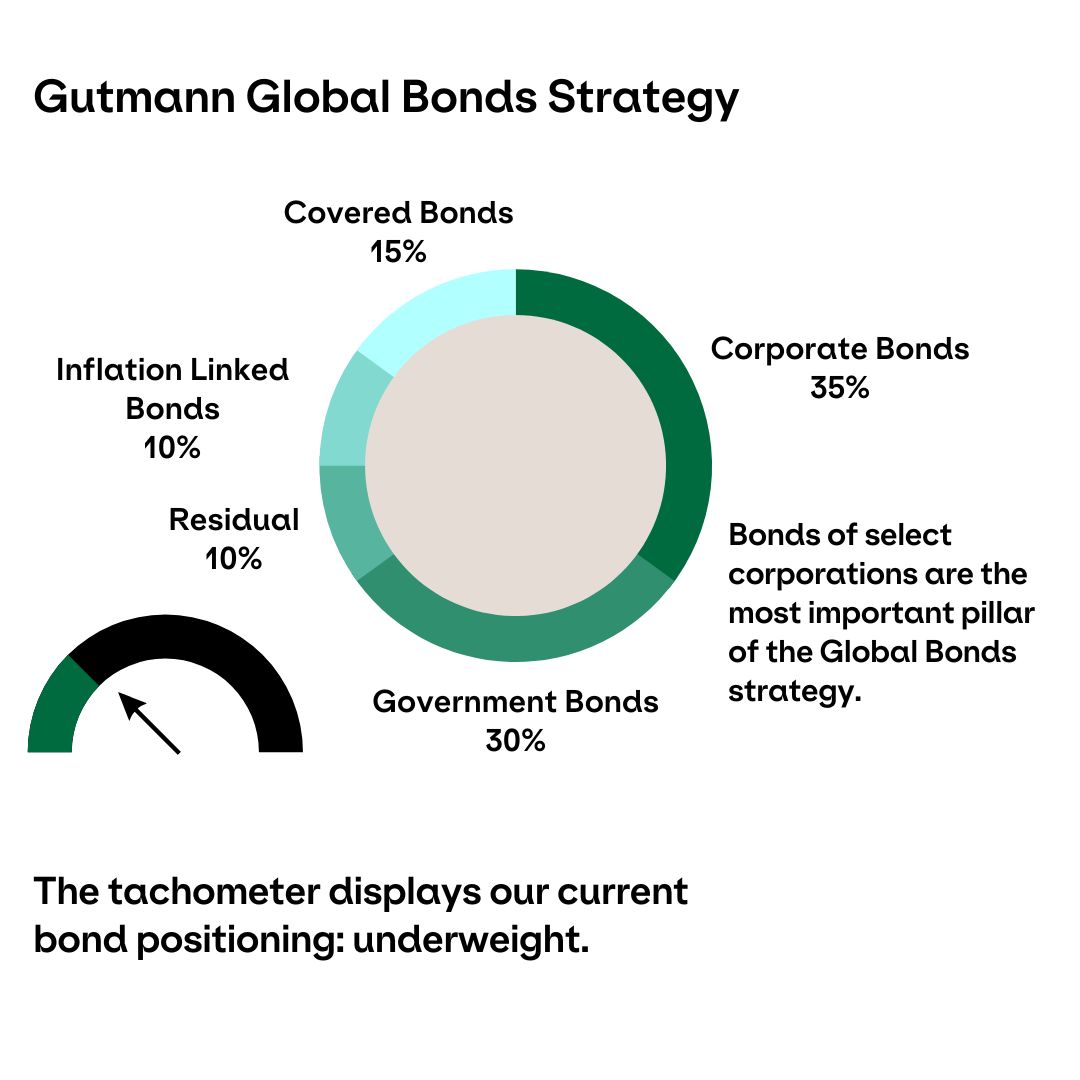

It was important for us to see that the companies in the Gutmann equity strategies were able to raise their prices in an inflationary environment and maintain their market position. Speaking of inflation. Even good companies must pay higher interest rates in the current environment. This is positive for corporate bonds, the most important component of Gutmann's bond strategy. Bonds issued by companies with good credit ratings are again paying around 4% for 5 years. With expected average inflation of 2.5% over the next 5 years traded on the markets, this is quite attractive.

Gutmann focuses on quality in equities and bonds. Companies are at the heart of both major asset classes. We are deeply convinced that entrepreneurship is the best way to grow wealth in real terms.

Coped extremely well with the volatile period.

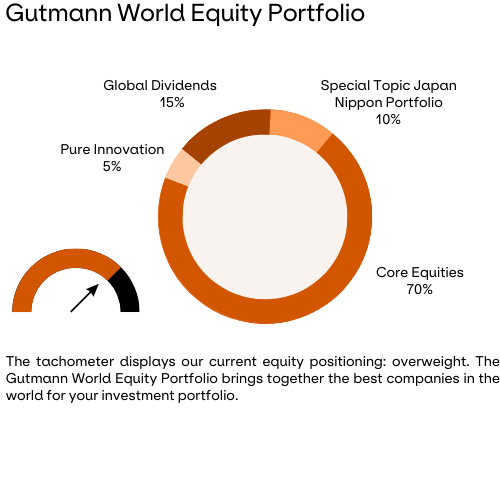

The Gutmann World Equity Portfolio is based on a solid foundation of different equity strategies. Stock selection is determined by the quality of the companies' business models and the most important topics for the future.

Prepared for different scenarios.

The first quarter showed once again that developments such as a sudden bank run are unpredictable. A look at our stock and bond portfolios showed that we were well prepared. We cannot spare our clients market fluctuations. Rather, it is important to avoid permanent capital losses.

We cannot promise that the stocks and bonds of companies, banks, municipalities, agencies, and sovereigns we select will never be affected by threatening developments. But our disciplined focus on quality increases the likelihood that such events will remain a rarity. Our first imperative is to protect our clients’ assets. The second imperative is to increase wealth in real terms. Whatever we do to achieve this must not conflict with the first imperative.

Please contact us today if you have any questions.

Do you have questions?

- We will be happy to answer your questions and help you with your concerns. Please contact the private clients team or send an e-mail to portfolio-management@gutmann.at

- This is a marketing information. Investment in financial instruments respectively investment funds is subject to market risks. Past performance is not indicative of future returns. Forecasts are not necessarily indicative of future results.

Gutmann Global Bonds Strategy may invest mainly in categories of assets other than securities or money market instruments.

Due to the composition of the portfolio and the used portfolio management techniques the Gutmann Core Equities, Gutmann Global Dividends, Gutmann Pure Innovation and the Nippon Portfolio under certain circumstances can show an increased volatility, i.e. the value of units may be exposed to high up- and downturns within short periods of time.

Further Information on the main risks of the Fund can be found in the Key Information Document ("PRIIPs-KID") as well as the prospectus or the information for investors pursuant to Article 21 German Act on Alternative Investment Fund Managers (AIFMG - Alternatives Investmentfonds Manager-Gesetz) under the item "Risk profile of the Fund".

The Funds pursue an active management strategy without reference to a benchmark.

All figures made without guarantees. Errors and omissions excepted.

For interested parties the Key Information Document (“PRIIPs KID“) in accordance with the Regulation (EU) No 1286/2014 for Nippon Portfolio, Gutmann Global Bonds Strategy, Gutmann Core Equities, Gutmann Global Dividends and Gutmann Pure Innovation respectively the prospectus in accordance with section 131 InvFG for Nippon Portfolio, Gutmann Core Equities, Gutmann Global Dividends and Gutmann Pure Innovation respectively the Information for investors according to section 21 AIFMG for Gutmann Global Bonds Strategy in their current versions are provided in German language free of charge at Gutmann KAG and Bank Gutmann AG, both Schwarzenbergplatz 16, 1010 Vienna, Austria and on the Website www.gutmannfonds.at as well as for Nippon Portfolio, Gutmann Core Equities and Gutmann Global Dividends at the German information center Dkfm. Christian Ebner, Attorney at Law, Theresienhöhe 6a, 80339 Munich as well as for Nippon Portfolio at the Dreyfus Söhne & Cie AG, Aeschenvorstadt 14-16, 4002 Basel. The distribution of fund units was notified to the German Federal Financial Supervisory Authority (BaFin). Gutmann KAG may de-notify the distribution of funds in Germany as far the conditions according to Art 93a of Regulation 2009/65/EG are fulfilled.Further information on the sustainability-relevant aspects of the Fund can be found at www.gutmannfonds.at/gfs.

This information has been created by Bank Gutmann AG, Schwarzenbergplatz 16, 1010 Vienna. Bank Gutmann AG hereby explicitly points out that this document is intended solely for personal use and information. Publishing, copying or disclosure by any means whatsoever shall not be permitted without the consent of Bank Gutmann AG. The contents of this document have not been designed to meet the specific requirements of individual investors (desired return, tax situation, risk tolerance, etc.) but are of a general nature and reflect the current knowledge of the persons responsible for compiling the materials at the copy deadline. This document does not constitute an offer to buy or sell nor a solicitation of an offer to buy or sell securities. Information to investor rights is available on the website www.gutmannfonds.at/gfs and are provided on request in German language at Gutmann KAG and Bank Gutmann AG.

The required data for disclosure in accordance with Section 25 Media Act are available on the following website: https://www.gutmann.at/en/imprint.